The Economic Landscape: How Texas Cities are Coping

In the heart of Texas, cities and counties are feeling the squeeze of a challenging economic landscape. Despite urban growth, such as Fort Worth's recent ascension as a city that surpassed a million residents, local governments are grappling with budget deficits. Fort Worth alone faces a staggering $17 million budget shortfall, a reality mirrored in various municipalities across the state, illustrating a broader trend of financial tightening amid economic uncertainty.

Inflation and Revenue Challenges

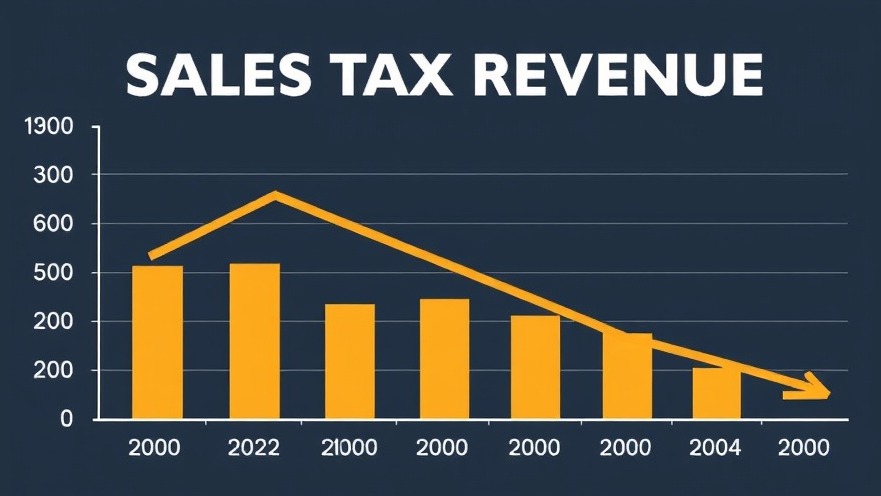

The dual pressures of inflation and stricter state-imposed limits on property tax collections have left many local governments scrambling to cover essential services. With citizens diverting more of their income towards housing and food—expenses that are generally exempt from generating sales tax—local revenue streams are dwindling. In cities like Austin, where sales tax grew impressively by over 21% in 2022, budget writers are now worried about a revenue plateau, with projections indicating little to no growth for the current fiscal year.

Understanding the Importance of Sales Tax Revenue

Sales tax is the lifeblood for Texas cities, funding everything from public safety to infrastructure. However, recent trends paint a concerning picture—cities are experiencing sluggish growth in sales tax revenue, with forecasts averaging less than 5% growth, significantly lower than the double-digit increases seen in the years immediately post-pandemic. As the Texas economy slows, the implications on public services, including police and fire departments, could be monumental.

Urban Development vs. Financial Reality

The juxtaposition of urban development and fiscal responsibility is stark. Cities like Fort Worth and Austin are witnessing rapid population growth yet are constrained by financial limitations. This paradox raises critical questions about how local governments can sustain services while navigating economic restrictions. As urban sprawl continues, the challenges facing these cities reflect broader national trends, where economic models must adapt to maintain growth without sacrificing fiscal health.

Consumer Confidence and Its Impact

Shifting consumer confidence also plays a significant role in the financial health of Texas cities. As families cut back on discretionary spending due to rising costs, the drop in sales tax revenue exacerbates the budgetary strain. Fluctuations influenced by external factors, such as tariffs from former administrative policies, add another layer of complexity that local budgets must navigate.

Looking Ahead: Future Implications for Texas

As Texas cities brace for potential budget shortfalls, the outlook remains cautious. Analysts suggest that the trend of rising inflation, declining sales tax growth, and population demands on services will force city governments to consider tough measures—either cutting essential services or seeking alternative revenue avenues. The conversations surrounding fiscal management are more urgent than ever, given the projected economic slowing and the anticipated increase in demand for public services from a growing population.

Key Takeaways For Residents

Understanding these dynamics is crucial for Texas residents. As budgets tighten, citizens must stay informed about how changes in local taxation, service availability, and community funding efforts will impact their daily lives. Engaging with local news sources and participating in community discussions can empower citizens to support and advocate for the best interests of their neighborhoods.

In conclusion, the story of Texas cities is one of resilience amid challenges. Local governments are finding innovative ways to adapt to a shifting economic landscape, and residents have a crucial role to play in shaping the future of their communities.

Add Element

Add Element  Add Row

Add Row

Write A Comment